QRMP- A headache we never asked

Written By CA Harshil Sheth dated: 2nd March, 2021

10 Min Read

Half baked solution & probably Worst Innovation of GSTN ARTICLE ON PROBLEMS / LIMITATIONS in QRMP SCHEME

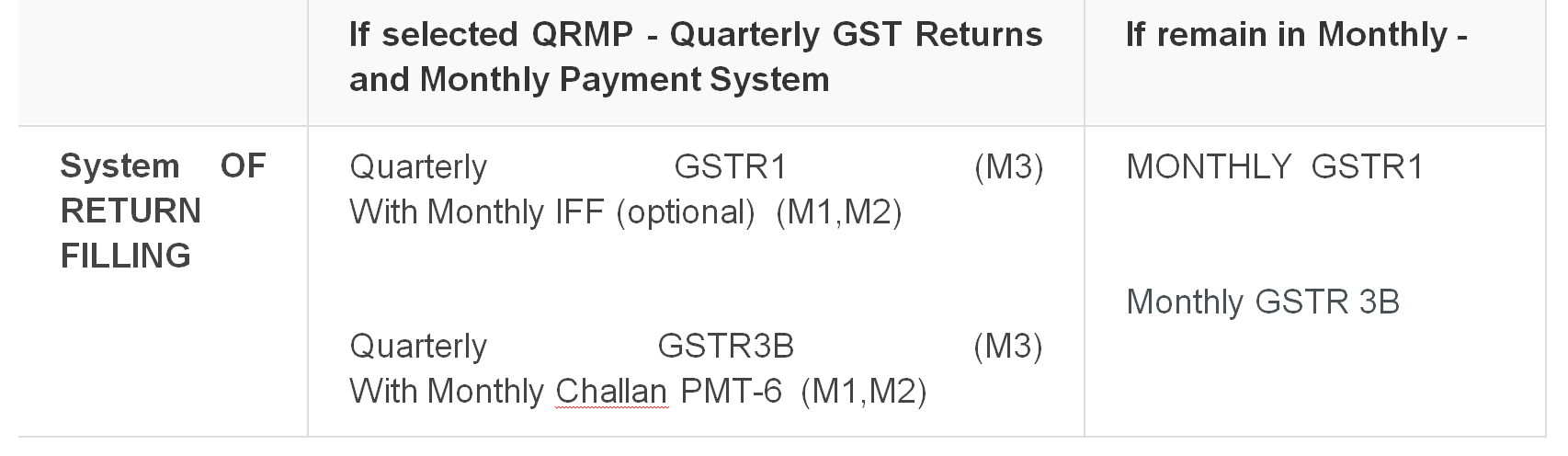

QRMP-It is introduced as “Quarterly Return Filing and Monthly Payment of Taxes (QRMP)” scheme under GST to help the taxpayers having turnover less than Rs. 5 crores. QRMP as we all know that it is scheme for Small dealers (only applicable to those who are having TO less than 5 crores) for giving relaxation in monthly compliances and a middle way to collect monthly tax from them. However, when you go deeper, It Seems same as earlier. It is monthly system with monthly compliance and additionally Quarterly compliances. The QRMP scheme allows the taxpayers to file GSTR-3B on a quarterly basis but pay tax every monthly. So you have to calculate monthly. Nothing New. So, majorly following way compliances will be.

Whatever option you select for 5cr less TO parties, hardly makes difference. IF YOU SELECT MONTHLY then monthly R1 + monthly 3B . IF YOU SELECT QUARTERLY then Quarterly R1 with Monthly IFF & Quarterly 3B With Monthly Challan Who came up with this Messed up idea? Now let's first understand IFF & problems/ limitations it has.

Disclaimer- Whatever written here is not to criticise but I would like to point out Problems / Limitations that this QRMP SCHEME has in its design. Problems What a professional would have faced for QRMP scheme in Practical life during Jan-Feb 2021 .

IFF

As you are aware that IFF is Invoice Furnishing Facility (IFF) is an optional facility provided to upload B2B invoices for those quarterly taxpayers who want to pass on input tax credit (ITC) to their recipients (buyers/customers) in first two months of a quarter.

PROBLEMS with IFF ( These are problems as well as limitations of this scheme )

1. Headache of Segregation –

IFF is nothing but GSTR 1 with only B2B & CDNR sheet.( Even You have to file same way GSTR 1 is filled. i.e DSC OR OTP ) . In practical life , As a professional, I can say that Clients are sending GSTR 1 monthly only. ( even if you ask IFF. Problem is GSTR -1, which they are sending, has B2C, EXEMPTED, EXPORT data . Because accounting software will not understand IFF & GSTR 1 difference. So it will your job to bifurcate these non-B2B data & remember for 1 or 2 months so as to report in GSTR -1 QUARTERLY filling. Of course, GST software filling solutions will take care of this . But Its cumbersome process. We still have to remember that there is some data to merge in QUATERLTY GSTR -1 . If they have gone for full-fledge GSTR 1 then things would have been easy. IFF को “optional GSTR 1” बोल दिया होता और उसमे B2C, export, exempt की module भी होती तो कितना easy हो जाता Quarter end मे. Why they always come with half baked ideas? Here they could have easily provided full-fledge GSTR -1. If so, We don't have to remember that NON-B2B data is still remaining to add in Quarterly GSTR 1. This half baked Idea of IFF is very frustrating to all professionals. It does not allow B2C and export and Exempted details So We have to remember all this for 2 months and report in QUATERLY GSTR 1 practically more confusing & time consuming.

2. ITS NOT OPTIONAL in most case-

Since IFF is an optional facility, it poses no additional compliance burden. Yes It is considered optional, but indirectly it has became Monthly Compulsory compliance for many. It is a facility for those quarterly filers who intend to pass ITC to their recipients in first two months of the quarter. But In Majority cases, Where QRMP dealer is issuing a B2B invoices, counter party will hold payment until if this transactions of sales are not showed up in GSTR 2B until 13th after end of month. So, In most of cases , IFF has become Monthly compliance only (with also additional load of segregation of non b2b data) . GSTN had No guts to say directly so this is the reason of this scheme to convert all to monthly filing indirectly. Directly they cannot say के सब Monthly हो जाओ , So they brought IFF . Fine.

To manage Team, Clients, Works - Its Free

*(Avoid Excel at any cost, very ineffective and inefficient tool to manage Practice)

3. CUT OF DATE OF 13TH ANOTHER PROBLEM -

Of course as a professional, I understand that One has to upload his B2B invoice till 13th then only Counter party can avail ITC . However, I suggest that GSTN could have allowed to file IFF even after 13th of date. Even if Counter party will not get ITC in same month . Because In practical life, If Client has given IFF data late for Jan-2021 month ( i.e after 13TH Feb ) or suppose staff forgot to upload IFF till 13th Feb., , We as a professional , have to remember these transactions & they will now be reported in next month since IFF screen will not be open after 13th FEB. On other side, GSTR 1 (monthly) is allowed to file even after 11th date . So looking to that , I say that GSTN could have allowed . This could have save Professionals in M2 month from additional burden of remembering what is not filled mistakenly in last month.

4. LIMIT OF 50 LACS – WHY RESTRICT INVOICE based on some random limit?

The total value of invoices that can be uploaded per month is restricted to Rs.50 lakh. This limit is creating huge level of problem that one has never imagined.

1. What if dealer has no sales in JAN-2021 and 60 lacs sales in FEB-21 . How would he report remaining 10 lacs invoice ? He must wait for march GSTR -1 to report these What if counter party will hold payment for these 10 lacs not showing in his GSTR 2B? Or What if seasonal business and some months are having invoices of value more than 50 lacs ? what to do in those months if such season occurring in first two months of any quarter?

2. What if one miss chance to file IFF if JAN-21 till 13th Feb. and when he upload invoices of Jan+ Feb. in Feb -2021 IFF , It would happen that It might cross 50 lacs . How disheartening he will feel ? This has happened recently. That's why I am saying that practically it worst kind of innovation of GSTN

3. Why GSTN site assumes that Business sale cycle is evenly distributed in year that each month sales would be nearly around 50 lacs ? Why they frame this kind of limit?

Now , Lets understand PMT -6 facility .

PMT-6

As we know that Monthly Payment of Taxes in QRMP Scheme can be done in PMT-6 challan. However, It same challan that we used to pay . So as such there is no Compliance. Payment can be made in the first two months by a simple challan in FORM GST PMT-06.

Now let’s discuss Limitations the way idea of PMT-6 & its methods are designed. The flaws in idea of PMT-6

1. WHY EVEN NEED PMT -6 in M1, M2 and a Quarterly GSTR 3B?

GSTR 3B was very smooth. PMT 6 is challan but We still have to compute the way you did GSTR 3B.They should have continued with GSTR 3B for all . Clients will give data same way he used to give data FOR GSTR 3b EARLIER . Same efforts We as professional require to give for PMT-6 also ( If going for Self assessment method) . Alternatively, If they really want relaxations for Small dealers. Why can't bring QUARTELRY 3B without PMT-6 ? As per some report, Small dealers contributes only 7-10% share in Revenue in GST COLLECTIONS So why can’t they bring purely Quarterly 3B without PMT-6?

2. NO SET –OFF IN M1 & M2 , CASH LYING in CASH LEDGER -

By the way, nothing is getting set-off. PMT -6 is not even a return . It's a challan. And Payment made in M1 / M2 will be lying in Cash ledger only. Be it, any method, You used for computation. The cash lying in cash ledger may be not used for payment for any other purpose . However , Still Govt is not getting this cash either . So why PMT-6 needed in M1, M2 ? Why can't make Quarterly GSTR 3B without this absurd idea of payment of challan in M1 , M2. That is why , This PMT6 is useless idea.

3. UNNECESSARY 2 METHODS PROVIDED

In first two months of the quarter, payment of liability can be made by either of the following two methods: a. Fixed Sum Method: Portal will generate a pre-filled challan in Form GST PMT-06. The system generated pre-filled challan in this case is commonly also known as 35% challan. b. Self-Assessment Method: The actual tax due is to be paid through challan, in Form GST PMT-06, by considering the tax liability on inward and outward supplies and the input tax credit available for the period as per law. Different methods of tax calculation will bring more confusion in calculating taxes every month. If fixed sum method is followed for cash payment, there can be scenarios wherein relevant quarter’s cash liability is considerably lesser than the previous quarter’s net cash payment. In such scenarios, excess cash may remain deposited and this will lead to blocking of taxpayer’s working capital. So, Fixed sum will be least choice as it will blocking working capital unnecessarily. I found Fixed sum method is double edge sword, unnecessary of all.

4. INTEREST

In Fixed Sum Method: No interest would be payable which is understood that One is paying on lumsum way. Self-Assessment Method: Interest amount would be payable as per the provision of Section 50 of the CGST Act for tax or any part thereof (net of ITC) which remains unpaid / paid beyond the due date for the first two months of the quarter. Now , problem is why interest levy in Self – assessment method? I am asking about Intention. Why can’t they give relaxation in this? If they can't give relaxation then Monthly system & QRMP scheme will have no difference if one is paying under self – assessment method.

5. ALL ITC RESTRICTIONS APPLICABLE IN SELF ASSESSMENT METHOD.

Another problem is that when you compute Challan in Self assessment method for M1 OR M2 , You still require to consider GSTR 2B & restrictions of 36(4) still applicable in such case. . Then how come It makes any difference than “Monthly” GSTR 3B scheme? You get my point, Better be in” MONTHLY “ return filling scheme . Again , If they can't give relaxation in this then Monthly system & QRMP scheme will have no difference if one is paying under self – assessment method.

6. UNANSWERED QUESTION- WHAT IF CHALLAN PAID IN WRONG PATH?

⇒ If a regular taxpayer makes payment through Form GST PMT-06 after selecting the reason “monthly payment for quarterly return” then what is the recourse? ⇒ If a quarterly taxpayer makes payment through Form GST PMT-06 after selecting the reason “any other method” then what is the recourse?

7. WHAT IF CREDIT AT THE END OF 3 MONTHS ? WHAT IS PURPOSE OF PMT-6 OF M1 M2?

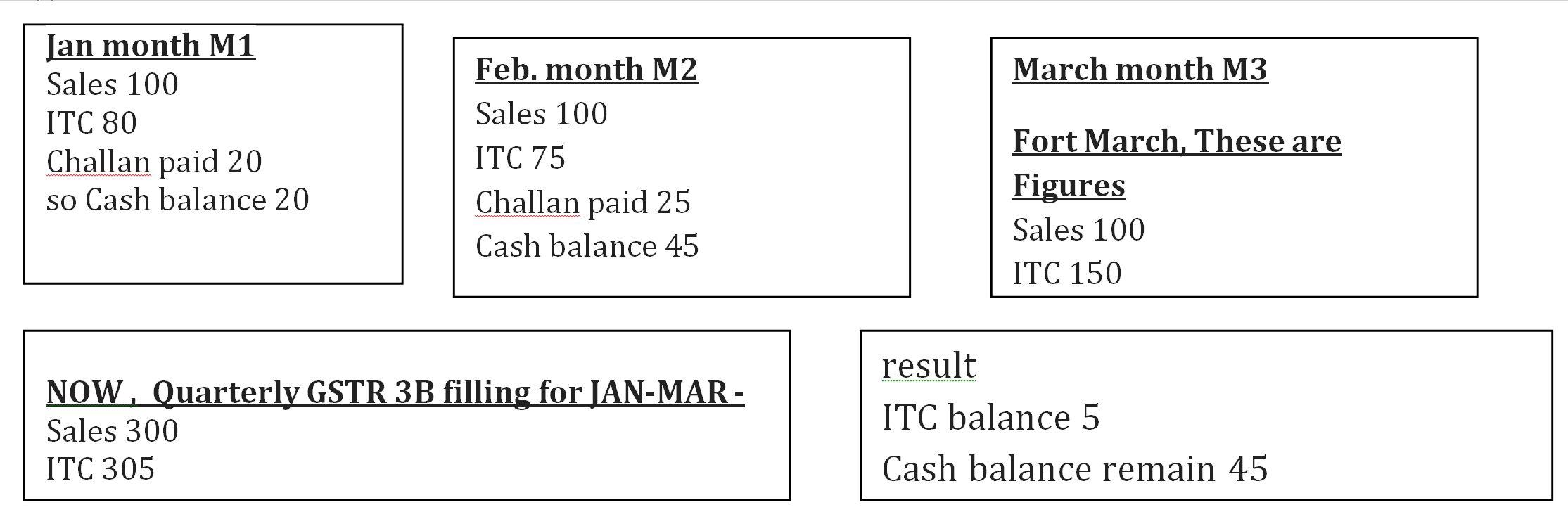

I explain this point with Case study - ( spare your 2 mins, It will give more insights)

As You see above, We paid challan in M1 & M2... (same like "Monthly scheme ") . Now , I am having Cash balance at the end of Quarter , which I may be allowed to claim refund . At the end I feel what's point whole purpose. What is point of whole exercise. ? Again asking, Why can't bring QUARTELRY 3B without PMT-6 ? If they have made Quarterly 3B without PMT 6 then there was no payable At All if u see Quarterly 3B.. But reality is different.

8. Why saying Quarterly return ? It all Monthly only. Why wrong promotion?

QRMP is wrongly promoted as LESSER compliance to MSME Rather it is more . In case of MONTHLY Parties , monthly GSTR1 monthly GSTR3b, In case of QUATERLY parties- Quarterly GSTR1 With Monthly IFF and Quarterly GSTR3B With Monthly Challan ( where same efforts to compute but Hardly name changed. Hats off) Things would have been very smooth, If they have brought QUARTERLY GSTR 3B without PMT-6 in M1+M2 Then , No above problem would have arise.

Actually what has happened to Quarterly dealers – पहले GSTR 3B monthly था + GSTR 1 Quarterly था , अब GSTR 1 monthly हो गया , GSTR 3B Quarterly हो गया with Monthly computation for PMT-6 challan And What has happened with Professionals? Unending headache till quarter end. Merging data of 3 months for GSTR 3B FOR QUARTERLY DEALERS for who earlier given data month wise for PMT -6 and asking Quarterly GSTR 1 where earlier we asked data for only B2B in M1 + M2. Finally ,all will agree that QRMP full form "Quarterly रहेगा पर Monthly परेशानी " Earlier, People complaint about GSTR 1 / 3B monthly burden of compliances in small dealers .So People asked for QUARLTERLY OPTION . So, Govt. introduced QRMP . Now people will beg to bring back GSTR 1 / 3B monthly.

That's, Marketing strategy by GSTN worked perfectly.

And at last , I would say that QRMP - Idea is good But half-baked. It is solution first imagined by IT engineers & then come to law. Things getting very difficult in practical life .Better to switch " Monthly " . It is irritating cycle of 3 months . & QRMP will frustrate all the Tax Professionals and Tax Payers to such an extent that you ultimately convert to Monthly filing.

Disclaimer:The information contained in this website is for general information purposes only. The information is provided by PracticeGuru and while we endeavour to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk. In no event will we be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website.

You may send in your articles on [email protected] . We will publish them on our website with credit to you.

Comments

Now ask question in any of the Categories of finance, tax and related areas and get Answers from Experts on practiceguru.pro

Ask QuestionsSubscribe for Updates

Want to Grow Practice and Put it on Auto Mode

Register NowRecent Articles

4 Thing to Focus to Grow CA Practice

Top Networking Ideas for CAs