GST Engagement Letter

Written By PracticeGuru dated: 9th Jul, 2021

2 Min Read

Being a Chartered Accountant or a GST Consultant, you need to cover your risks while engaging with a client for filing their GST Return. A well drafted engagement letter can go a long way to ensure this. We have give below a suggested engaggement letter which you can change, adapt and use with your clients.

Draft Enagement Letter

This is only a draft and you should adapt it as per your needs and actial terms of engagement with your clients.

If you want a Editable Draft copy of this letter for personal use, please whatsapp us on 9136667325.

Example of GST Return Filing Engagement Letter

Filing of GST Returns as per the Provisions of GST Act

To, the Board of Directors of ..................

(name of the Entity)

(Address)

Dear Sirs,

I / We refer to the letter dated _________ informing me / us about my / our (re) appointment/ratification as the GST consultants of the Company for the purpose of filing GST Returns.

You have requested that I / we file GST returns as per the provisions and notifications of the GST Act., for the financial year(s) beginning April 1, 20XX and ending March 31, 20YY2 .

I am / We are pleased to confirm my / our acceptance and my / our understanding of this engagement by means of this letter at the fees mentioned in the annexure A attached to this letter.

My / Our engagement will be conducted with the objective of filing returns as required by/ / consult on matters of GST Act in the manner so required.

In filing the returns, for GST Audits and appearing for and representing in litigations for the company, I / we will rely on the workings and books of accounts provided to us. It is required that I / we comply with deadlines of the act and plan and perform the engagement and give our opinion on applicability of various sections of the Act. It will not be our responsibility to check whether the data is free from material misstatements.

Because of the inherent limitations of such an engagement there is an unavoidable risk of interpretation, etc……

My / Our engagement will be conducted on the basis that the Management acknowledge and understand that:

a) We are not responsible for the correctness of the data. We are not responsible for the correctness of the claim like ITC although we may give our opinion on it, ultimate responsibility of claim will be of the management. Management absolves us from all the liabilities in case such claim is denied by the department.

b) Management has given us the access to their GST login and digital signature to be used for filing the return.

c) Filing of return will be based on the final data received on email to our email id - ______________________.

d) We will have to disclose the data to government authorities if they call upon us.

e) We will get data 3 days before the due date of filing the return, management will be responsible for any delay by you which results in delay in filing the return, consequent late fees and interest (if not waived off by government).

f) They have the responsibility of taking proper and sufficient care for the maintenance of adequate accounting records which are true and correct.

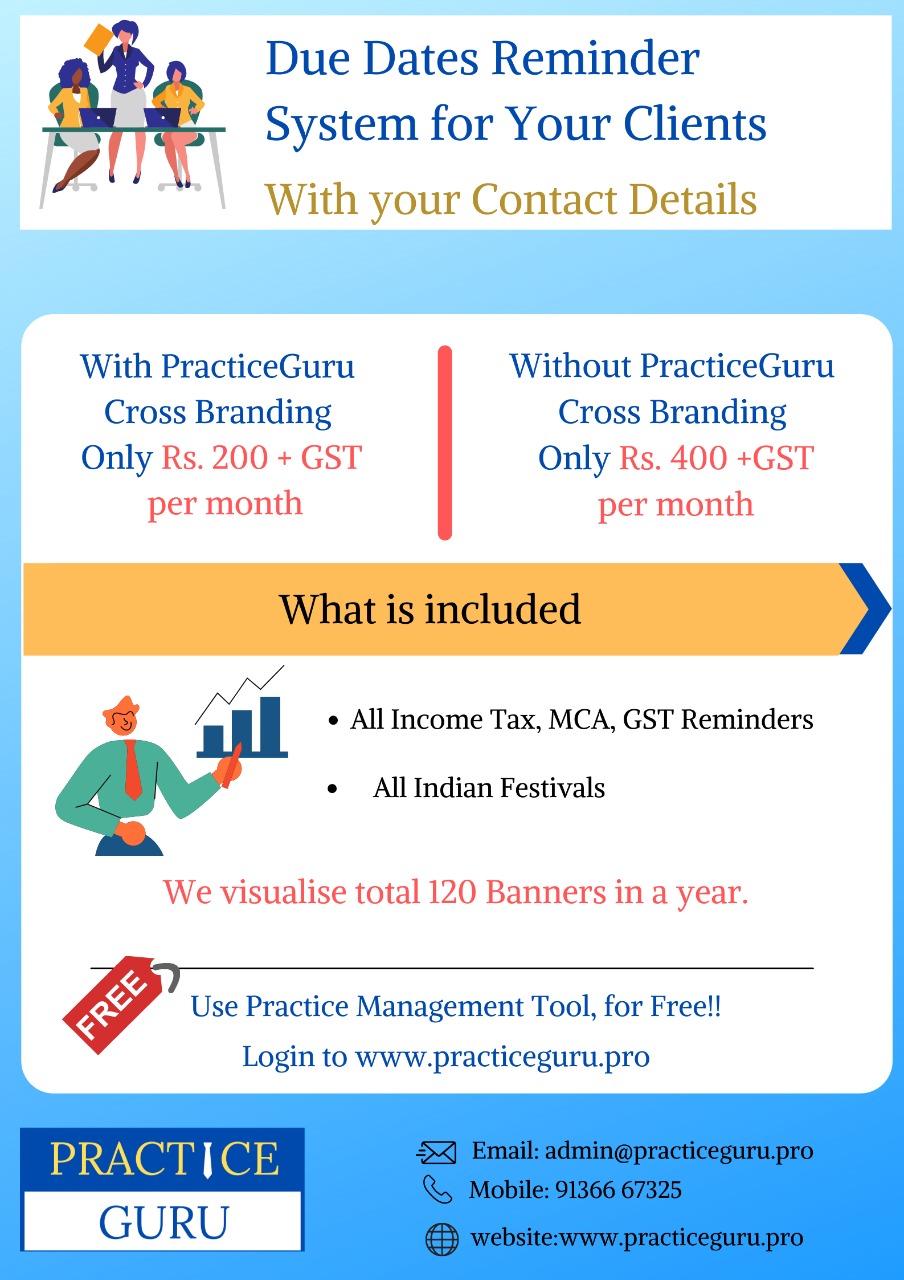

PracticeGuru Branding Posters

Starting at Rs. 200 only.

Now Without PG Branding Annnual subscription is available at Rs. 2880 ( Savings - Rs. 1920)- payment link- Click here

With PG branding Annual Subscription is available at Rs. 1440 ( Savings - Rs. 960) - payment link - Click Here

g) they have the responsibility of laying down internal financial controls to be followed by the Company and that such internal financial controls are adequate and were operating effectively; and

h) they have the responsibility of devising proper systems to ensure compliance with the provisions of all GST laws and that such systems were adequate and operating effectively.

i) Management has the responsibility of identifying and informing me / us of financial transactions or matters that may have any effect on the filing of the returns and disclosures.

j) Management has the responsibility of identifying and informing me / us of which need to be disclosed to us.

k) Management has the responsibility of informing me / us of facts that may affect GST return filing, of which Management may become aware during the period from the date of my / our report to the date the GST returns are filed.

l) To provide me / us, inter alia, with: (i) Access, at all times, to all information, including the books, accounts, vouchers and other records and documentation of the Company, whether kept at the Head Office or elsewhere, of which the Management is aware that are relevant to the Gst return filing. This will include books of account maintained in electronic mode;

m) Unrestricted access to persons within the Company from whom I / we deem it necessary to obtain data. This includes my / our entitlement to require from the officers of the Company such information and explanations as I / we may think necessary for the performance of my / our duties as the GST consultant of the company; and

n) All the required support to discharge my / our duties as the consultant.

o) I / We look forward to full cooperation from your staff during my / our engagement.

p) Management will take final decision regarding options in GST Law like monthly or QRMP though we as consultant will give our opinion which option is better for the company.

q) In certain cases where option of OTP or Digital signature is given to upload the return, it is the final decision of management which option to select and give us authority to use dig sign or generate OTPs accordingly.

r) Management will indemnify us if any action is initiated by government on us as tax consultants.

PracticeGuru Branding Posters

Starting at Rs. 200 only.

Now Without PG Branding Annnual subscription is available at Rs. 2880 ( Savings - Rs. 1920)- payment link- Click here

With PG branding Annual Subscription is available at Rs. 1440 ( Savings - Rs. 960) - payment link - Click Here

s) Management confirms that there is no fraudulent actions taken by management, any employees or owners as far as compliance with GST Act is concerned.

t) Making of Einvoices / Eway bill will be responsibility of management though we may guide on the same.

u) Management understands and agrees that Appeal and handing of department notices will be separate work assignment and will be compensated as rates decided mutually between us.

Please sign and return the attached copy of this letter to indicate your acknowledgement of, and agreement with, the arrangements for my / our engagement.

Yours faithfully,

(signature)

(Name of the Member)

(Designation)

(Name of the Firm)

Disclaimer:The information contained in this website is for general information purposes only. The information is provided by PracticeGuru and while we endeavour to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk. In no event will we be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website.

Publish Your Articles

You may send in your articles on [email protected] . We will publish them on our website with credit to you.

Comments

Now ask question in any of the Categories of finance, tax and related areas and get Answers from Experts on practiceguru.pro

Ask QuestionsSubscribe for Updates

Want to Grow Practice and Put it on Auto Mode

Register Now

Recent Articles

QRMP- A headache we never asked

How to run a Successful CA Firm Stressfree