How to Select the Best Practice Management Software: A Guide Based on the 10 As

PracticeGuru

dated: 1st February, 20243 Min Read

In today's competitive landscape, tax professionals need to operate at peak efficiency to grow their client base and profits. A Practice Management Software (PMS) is no longer a luxury; it's a necessity.

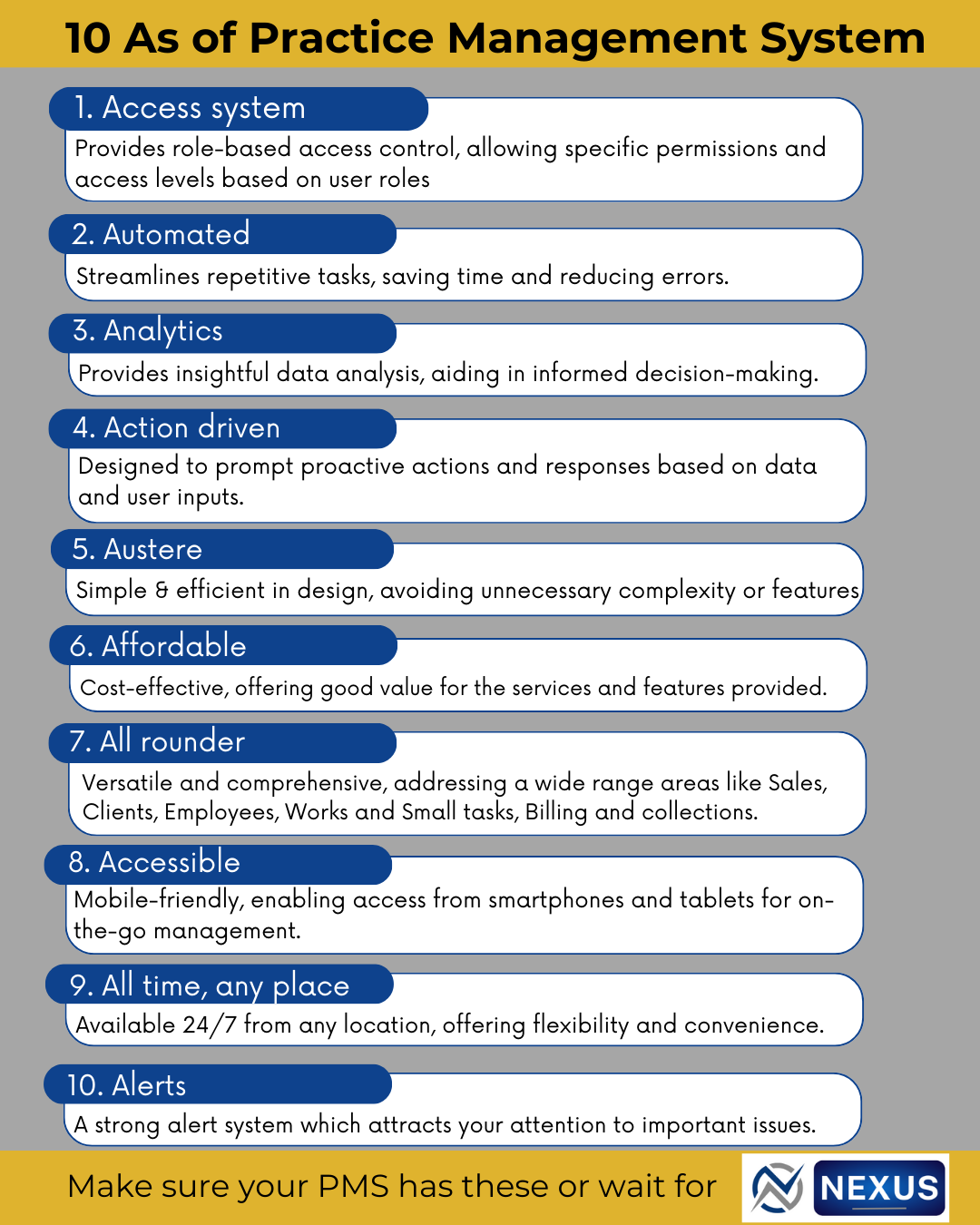

Here's how to select the best PMS for your needs, structured around the pivotal "10 As."

1. Access System

An optimal PMS must offer a sophisticated access system. This feature allows you to assign specific permissions and access levels based on user roles. With role-based access control, you ensure that only the right eyes see sensitive data, reducing the risk of breaches and maintaining client trust. A robust access system also streamlines workflow, as employees can quickly find the tools and data they need.

2. Automated

The heart of any efficient PMS lies in its automation capabilities. A system that streamlines repetitive tasks not only saves precious time but also significantly reduces the chance of human error. From client follow-ups to report generation, automation ensures a seamless operation. It's essential to choose a PMS that can handle these tasks with ease, allowing you and your team to concentrate on strategic, revenue-generating activities.

3. Analytics

Analytics is the compass for navigating your practice's success. The right PMS should offer comprehensive analytics, turning data into actionable insights. This means you can track key performance indicators, understand client behaviors, and forecast trends. Effective analytics tools in your PMS can lead to more informed decisions and a proactive approach to practice management.

4. Action Driven

Your PMS should be more than a passive repository of information—it should be action-driven. This means the system is designed to recommend proactive measures, alert you to key tasks, and prompt timely responses based on data analysis and user input. An action-driven PMS can serve as a co-pilot for your practice, helping you stay ahead of the curve.

5. Austere

Simplicity is often overlooked, but it's critical when choosing a PMS. An austere, or simple and efficient, design ensures that you're not bogged down by unnecessary features or complex interfaces. The best PMS is intuitive, straightforward, and focuses on functionality, making it easier for you and your staff to adopt and utilize the system to its fullest potential.

6. Affordable

Cost is always a consideration, and your PMS should offer good value. An affordable solution means it's cost-effective without compromising on essential features. It should align with your firm's size and budget, ensuring that the investment in the PMS translates into tangible benefits like increased productivity and profitability.

7. All-rounder

An all-rounder PMS is versatile and comprehensive. It should cater to a wide array of functions including sales, client management, task allocation, billing, and collections. By consolidating all these areas into one system, you streamline your practice's operations, enhancing overall efficiency and service delivery.

8. Accessible

In the age of mobility, a PMS must be accessible across devices. Whether you're on a tablet or smartphone, your PMS should be just a few taps away. This accessibility ensures that you can manage your practice on the go, responding to clients and overseeing operations from anywhere, at any time.

9. All Time, Any Place

Your practice doesn't stop when you step out of the office, and neither should your PMS. Look for a system that is available 24/7, from any location. This degree of flexibility and convenience is crucial for tax professionals who need to respond quickly to client needs and market changes.

10. Alerts

Lastly, a top-tier PMS should have a strong alert system. It keeps you informed about critical issues, deadlines, and opportunities. A good alert system can be the difference between missing a deadline and seizing an opportunity, keeping your practice proactive and on track.

In conclusion, choosing the right PMS like Nexus can revolutionize how you manage your tax practice. It should empower you with control, insight, and connectivity, ensuring that your practice runs smoothly, efficiently, and profitably. Remember the "10 As" as you evaluate your options, and choose a PMS that will help you maintain a competitive edge and achieve stress-free success.

.

Disclaimer:The information contained in this website is for general information purposes only. The information is provided by PracticeGuru and while we endeavour to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk. In no event will we be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website.

You may send in your articles on [email protected] . We will publish them on our website with credit to you.